Address

8200 Jones Branch Dr, McLean, VA 22102, USA

Telephone

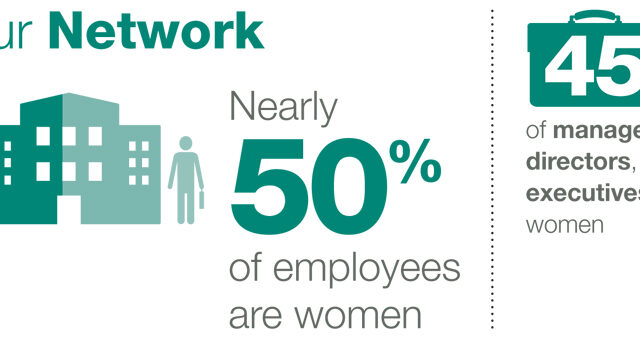

Freddie Mac promotes diversity and inclusion in contracting opportunities for minorities, women, and persons with disabilities, and minority-, women-, and disabled-owned businesses. We welcome all qualified diverse suppliers to view and consider Freddie Mac’s potential sourcing opportunities.

To be a potential diverse supplier at Freddie Mac you must meet the following minimum qualifications.

- Have an established place of business, been in business for at least one year, and be able to provide revenue amounts for the current year.

- Cannot acquire more than 70 percent of your revenue from Freddie Mac at the time of registration.

- Be able to provide, upon request, a certificate of insurance for the type and/or the level of business you wish to conduct with Freddie Mac.

- Be able to provide Freddie Mac with a W-9 form.

- Maintain at least three W-2 employees.

- Qualify as a diverse supplier based on the diverse supplier definitions outlined below.

- Be able to provide a third party diversity certificate (if applicable).

Minority-Owned Business

- More than 50% of the ownership or control of which is held by one or more minority individuals; and

- More than 50% of the net profit or loss of which accrues to one or more minority individuals.

- Minority means any Black (or African) American, Native American (or American Indian), Hispanic (or Latino) American, or Asian American.

Women-Owned Business

- More than 50% of the ownership or control of which is held by one or more women;

- More than 50% of the net profit or loss of which accrues to one or more women; and

- A significant percentage of senior management positions are held by women.

Disabled-Owned Business

- More than 50% of the ownership or control of which is held by one or more persons with a disability; and

- More than 50% of the net profit or loss of which accrues to one or more persons with a disability.Disability has the meaning defined in 29 C.F.R. § 1630.2(g), § 1630.3 and Appendix to Part 1630 – Interpretive Guidance on Title I of the Americans with Disabilities Act.

Service Disabled Veteran-Owned Business

- Not less than 51% of which is owned by one or more service-disabled veterans, or in the case of any publicly owned business, not less than 51% of the stock of which is owned by one or more service-disabled veterans; and

- The management and daily business operations of which are controlled by one or more service-disabled veterans, or in the case of a veteran with a permanent and severe disability, a spouse or permanent caregiver of such veteran.Service Disabled Veteran has the meaning described by the United States Department of Veterans Affairs at www.vip.vetbiz.gov.

Gay, Lesbian, Bisexual and Transgender-Owned Business (or GLBT-Owned Business)

- At least 51% of which is owned, operated, managed and controlled by one or more gay, lesbian, bisexual or transgender persons who are either United States citizens or lawful permanent residents;

- That exercises independence from any non-gay, lesbian, bisexual or transgender-owned business enterprise;

- With its principal place of business (headquarters) in the United States; and

Formed as a legal entity in the United States.This definition is from the National Gay and Lesbian Chamber of Commerce.

Great Service! Super lawyers!

Very good